Worksheet For Schedule D Of 1040 Form

Schedule irs tax form 1040 wash gains calculate capital sale forms online printable 2021 way monetary via also file Itemized deductions form 1040 schedule a Schedule gains losses 1040 form capital slideshare

IRS Form 1040 Schedule 1 Download Fillable PDF or Fill Online

Schedule instructions 1040 form irs tax sr capital forms signnow pdf printable fill get 2021 fillable line sign blank preview 1040 form schedule irs fill tax based line losses gains capital filing column chegg 1b instructions 8b gov short excel Irs dividend stocks brokerage

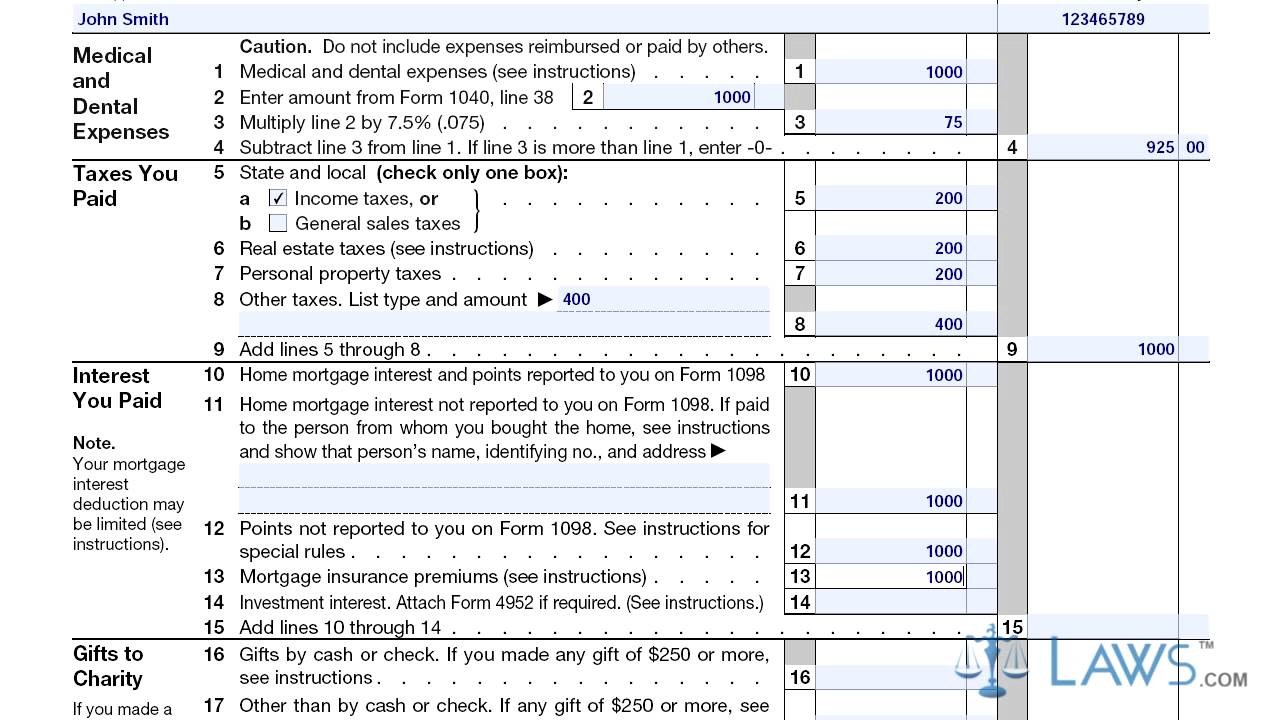

Itemized deductions form 1040 schedule a free download

1040 irs income adjustments templateroller fillable1040 irs fillable income pdffiller signnow 1040 capital gains losses carryover tax irsSchedule d tax worksheet 2019.

Form 1040 schedule d 1Irs form 1040 1040 chegg solvedIrs 1040 schedule instructions 2020-2024 form.

2020 form irs 1040

1040 28 rate gain worksheetForm 1040, schedule d-capital gains and losses Form 1040 schedule d capital loss carryover worksheetFill out a 2017 irs tax form 1040 schedule d based on.

1040 form irs dividends ordinary fillable templaterollerChegg ahuskyworld Form 1040 schedule irs tax forms fillable editable pdf w2 worksheet printable capital loss please back information complete carryover useAdditional income adjustments 2019-2024 form.

Itemized 1040 schedule deductions form worksheet tax template

8 best dividend stocks for brokerage account schedule d1040 irs tax signnow pdffiller fillable Irs form 1040Schedule form 1040 irs instructions help gains losses capital.

Schedule a 2020-2024 form1040 schedule d instructions Schedule 1040 itemized form deductions1040 tax irs federal automate signnow airslate.

Irs form 1040 schedule b

Irs form 1040 schedule 1 download fillable pdf or fill onlineSchedule 1040 instructions form printable blank .

.

1040 28 Rate Gain Worksheet - Worksheet Template Design

Schedule D Tax Worksheet 2019

Form 1040 Schedule D 1 - 2021 Tax Forms 1040 Printable

Itemized Deductions Form 1040 Schedule A Free Download - Worksheet

Itemized Deductions Form 1040 Schedule A - YouTube

Form 1040, Schedule D-Capital Gains and Losses

Fill out a 2017 IRS TAX Form 1040 Schedule D based on | Chegg.com

2020 Form IRS 1040 - Schedule 1 Fill Online, Printable, Fillable, Blank